The iPhone Air is the thinnest iPhone yet, with a 6.5 inch Super Retina XDR display, the A19 Pro chip, Apple Intelligence features and a tougher Ceramic Shield 2 front. It is also eSIM only and supports safety features such as Emergency SOS via satellite and Crash Detection. With a starting price of £999, it is a premium device that most of us would rather protect than pay to replace.

Below, we help you decide if iPhone Air insurance is worth it, what it typically covers, and how it compares to other options, using only the details you shared.

Quick answer

If you would struggle to afford repair or replacement for a £999 iPhone, or you rely on your phone daily for work, travel and payments, specialist iPhone insurance is a sensible safety net. It can cover accidental damage and theft as standard, with loss available on upgraded plans, and it shows your excess before you buy so there are no surprises.

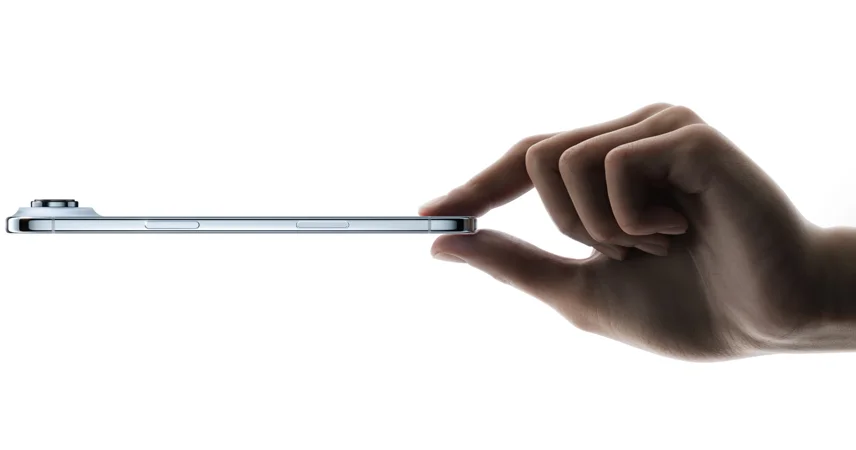

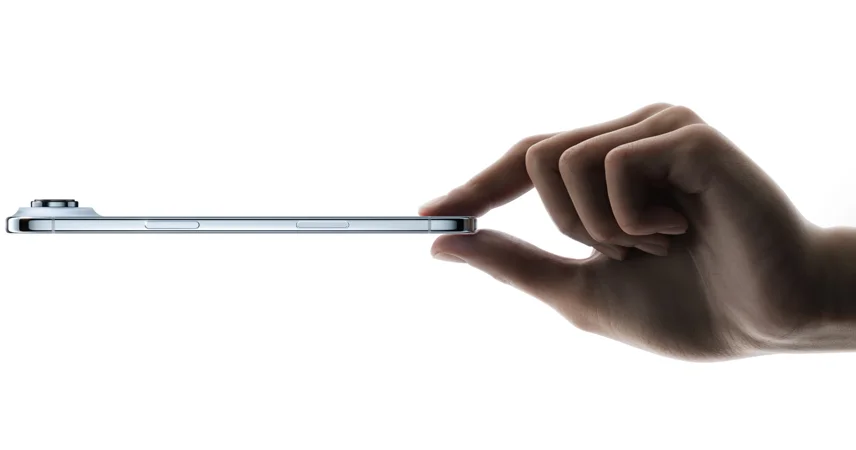

Why the iPhone Air is worth protecting

- Ultra thin and light design at 5.6 mm and 165 g feels great, but any modern smartphone can be vulnerable to drops, cracked screens and liquid mishaps.

- Pro grade performance with the A19 Pro and a 48 MP Fusion Main camera makes it costly to replace.

- All day battery and premium display mean you will use it more, which increases day to day risk.

- Travel friendly features such as eSIM only activation and worldwide connectivity make insurance with worldwide cover attractive.

iPhone Air A19 Pro Chip

What iPhone Air insurance usually covers

With loveit coverit you can compare iPhone Air insurance options for your exact model and see the excess up front.

- Accidental damage including cracked screens and liquid damage

- Theft with protection from unauthorised usage and like for like replacement on approved claims

- Optional loss on upgraded plans

- Mechanical breakdown outside manufacturer warranty

- Airtime abuse following theft or loss

- Accessory cover up to £175 for items such as a case or charger

- Worldwide cover in the UK, Crown Dependencies, Republic of Ireland and unlimited worldwide cover for one year

- Unlimited claims and repairs with no annual limit

- Fast, in house claims handling by a UK team, with typical replacements aimed for within 24 to 48 hours after approval, subject to stock and courier times

AppleCare Plus versus specialist iPhone insurance

AppleCare Plus

- Must be added within 60 days of purchase

- Covers accidental damage and can cover theft and loss on eligible plans

- Set claim limits and Apple service routes

Specialist iPhone insurance with loveit coverit

- Available for new and refurbished phones up to 36 months old when eligibility is met

- Can include theft, accidental damage and optional loss

- Unlimited claims while on cover

- Rolling monthly policies, no long contracts

- UK based claims support

If you miss the 60 day AppleCare Plus window, or you want unlimited claims and policy flexibility, an independent specialist can be a better fit.

Thin iPhone Air

How much does iPhone Air insurance cost?

Price depends on your model and choices. A higher excess can lower your monthly price, adding loss cover can increase it. If you are careful and rarely lose or damage phones, consider a lower premium with a higher excess. If you are prone to accidents, a higher premium with a smaller excess may suit you better. Use the comparison tool to see side by side prices for your exact iPhone Air and cover level.

When insurance makes the most sense

- You could not comfortably pay to replace a £999 phone

- You travel often and want worldwide cover

- You rely on your phone for ID, payments, photos and navigation

- You prefer unlimited claims and a clear excess shown before you buy

Eligibility and common exclusions to check

- The phone must not already be damaged at policy start

- The device must be purchased from a UK VAT registered company

- Devices older than 36 months cannot be covered

- Refurbished devices must meet grade requirements

- You must live in the UK

- Claims are not accepted if policy payments have not been made

Is iPhone Air insurance worth it

Insurance may feel unnecessary until something goes wrong. Without cover, a single loss or a serious drop can cost far more than the total you would have paid in premiums. If you value peace of mind and fast support from a UK team, it is an easy decision. If you are comfortable self insuring, compare the excess and likely repair costs first, then decide.

What to do next

- Compare quotes for iPhone Air on loveit coverit to see your price and excess before you buy.

- Choose Essential cover for core protection or add loss if you want fuller peace of mind.

- Check your eligibility and excess table so you know exactly what you would pay on an approved claim.

- Insure your iPhone with a rolling monthly policy and cancel any time, subject to terms.

By

Jonathan Owen

By

Jonathan Owen