Travelling as a couple but not always together: what to check

By

Jonathan Owen

By

Jonathan Owen Marketing Manager

Published

9th February 2026

loveit? shareit!

In plain English, it usually means one policy that can include two travellers on the same booking. That’s it. No romance test, no “prove you share a toothbrush” requirement.

Where it gets interesting is the admin: addresses, travel dates, and whether you’re always travelling together. If you want a simple starting point for cover for two travellers, it’s worth checking the details that apply to your situation before you buy.

Quick expectation setter: what’s included can vary by policy and circumstances, so treat this as a checklist and always check your policy wording and documents for the full terms.

Travel form being filled in with address details for two travellers

This is the big one. People often assume “two people on one policy” automatically means “same home address”. In practice, some insurers may allow it, others may not, and sometimes it depends on how the policy defines the relationship between travellers.

What matters is that the details you give are accurate and consistent. When taking out or changing a policy, you’re expected to take reasonable care to provide accurate and complete information.

Often, yes in some form, but it depends on what you’ve bought and how the trip(s) are set up. The key is to think in scenarios, not assumptions.

Two travel dates shown for a couple joining the same trip on different days

Alex flies on Friday. Sam joins on Monday. This can be fine in principle, but the dates matter. You’ll want to check whether each traveller’s cover (and each traveller’s trip dates) line up with the actual travel days, especially if the policy expects trips to start and end from the UK.

Maybe one of you nips to Milan for a long weekend while the other stays home (lucky them). The practical question is whether the policy is set up to cover each person’s travel independently, or only when travelling together. If anything about your circumstances changes, you generally need to tell the insurer as soon as reasonably possible.

This comes up a lot with annual policies: one partner has a work trip later in the year, the other doesn’t. It may be workable, but make sure you’re clear on who is named on the policy and what counts as a “trip” under the wording (for example, trips are usually pre-booked and within territorial limits).

When couples travel on different dates (or do separate trips), admin details become the difference between “smooth claim journey” and “paperwork tennis”.

Focus on these three:

Also worth knowing: policy documents often define a “travelling companion” broadly as someone you’re travelling or staying with (or have arranged to travel/stay with) and that person doesn’t necessarily have to be insured on your policy. That definition can help when you’re reading the wording around who counts as who in a claim scenario.

If you’re doing more than one trip in the next 12 months (including separate trips), annual annual cover may be worth a look. If it’s a one-off holiday with fixed dates, single trip cover is often the simpler option.

This is where people usually get caught out, not because they’re careless, but because travel admin is rarely anyone’s idea of a good time.

Passport next to booking details being checked for name accuracy

Airlines, hotels, and insurers tend to be extremely literal. A missing middle name or swapped surname can be enough to slow things down when you need to prove who is who.

“We leave around the 10th” is fine for a WhatsApp message, less fine for an insurance schedule. If you need to claim, you may be expected to provide details promptly and within the timeframes set out in the policy conditions.

Keep declarations consistent for each person. If anything changes, tell the insurer as soon as reasonably possible, and don’t assume “it’s probably fine” if it’s not reflected in the documents.

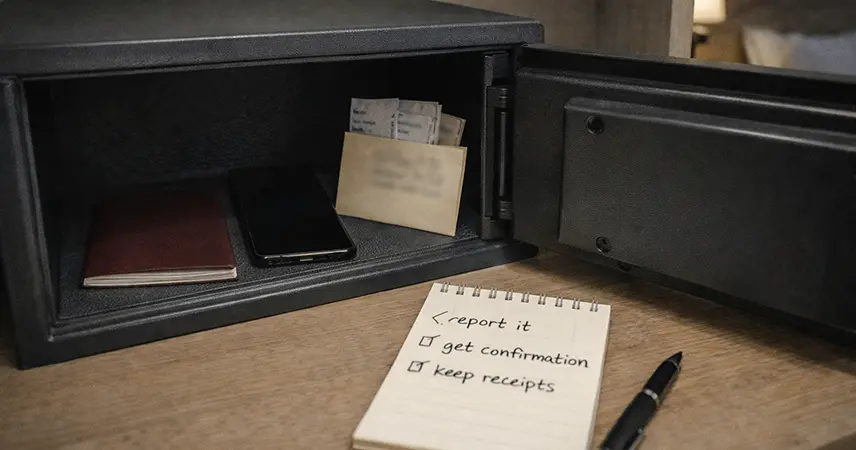

Travel documents and receipts stored safely for evidence if something goes wrong

If something goes missing, timing and evidence matter. Policies often treat “unattended” as not being in full view and not being in a position to prevent unauthorised interference.

For theft from accommodation, cover may depend on evidence of forced entry and a police report. And for valuables or documents, leaving them unattended may not be covered unless they were secured (for example, in a hotel safe) and properly reported to the hotel and local authorities.

Practical takeaway: if you’re ever in doubt, report it promptly, keep written confirmation where you can, and hold on to receipts or evidence of ownership.

Checklist of travel details to confirm before buying couples cover

One last (small but important) note: when buying or changing a policy, take reasonable care to provide accurate and complete information, so the documents match your real-world plans.

If you’re planning a trip as two people and want to sense-check the setup, start with our guide to travel insurance options, then work out which structure fits your logistics best. No hard sell. Just fewer “wait, does this count?” moments later.